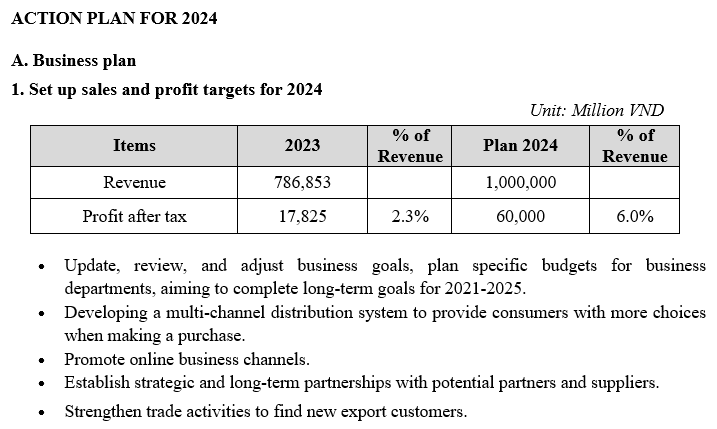

Everpia sets a profit target 2.3 times higher compared to 2023

In the recent annual report, EVE announced a cash dividend ratio of 5% and set a profit target 2.3 times higher compared to 2023.

With a complex economic situation and many difficulties, the Board of Managers has shown initiative and flexible response in managing and maintaining production and business activities to ensure stability and create momentum for future development such as expanding the agent network, transitioning to an omnichannel retail model, investing in product research and development and maintain collaborative relationships with partners and customers. At the same time, increase market inspection and and address counterfeit goods.

.png)

Everpia has been honored in the Top 100 sustainable enterprises for many consecutive years

Besides, in the rebranding Everon stratgey in the period 2021-2025, focusing on repositioning and enhancing the brand value, EVE researched the market, determined business strategies, built a product portfolio and signed exclusive agreements with suppliers. At the same time, they completed the product display for their first flagship store.

With the consistent strategies and actions, along with a strong recovery demand from customers around the world, EVE is confident in achieving the target profit of 2.3 times higher compared to 2023.

“I call 2024 the year of “revival” because we will build a plan and vision for 2024 based on the difficulties of recent years. The common point of all plans for 2024 is to emphasize the vision of sustainable development by ensuring value for stakeholders including shareholders, employees, local communities, customers, business partners and the Earth. We will continue to convey values to the family life of each customer through maintaining quality and introducing to the market new products with outstanding improvements." – Mr. Lee Bang Hyun - Director of B2C & Online of Everpia JSC shared.